石油巨头一直在创造创纪录的高利润,但这并没有改变它们的资本纪律,因为它们正在为下一次油价暴跌做好准备

标准普尔500指数的能源板块自今年年初以来已经下跌5%,反映出人们对经济衰退将拉低油价的担忧

运营成本上升、利率上升以及石油和天然气价格下跌等因素表明,石油巨头的好时光或将很快就要结束

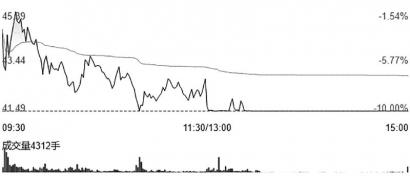

【资料图】

【资料图】

中国石化新闻网讯 据油价网2023年5月9日报道,石油巨头从去年的能源危机中赚取的巨额现金已成为传奇故事。

无论是用暴利税来威胁石油行业,还是被活动人士用来给已经被妖魔化的石油行业形象增添更多细节,这样的武器都不再特别奏效。

与此同时,石油行业一直保持低调,降低了资本支出。由于油气公司寻求为下一次价格暴跌做好准备,资本自律的趋势似乎已在油气行业中根深蒂固。

《华尔街日报》本周报道称,标准普尔500指数中最大的7家油气公司的现金总额已超过800亿美元。仅埃克森美孚公司一家公司的现金储备就接近300亿美元。雪佛龙公司的现金储备超过156亿美元。石油巨头中规模最小的依欧格资源公司也拥有超过50亿美元的现金储备。

“石油巨头一直在分红。这是一个标志,”能源投资公司Tortoise的董事总经理Rob Thummel如是告诉《华尔街日报》记者,“但现在除了股息,还有多余的现金可以用来回购股票。”

这就是过去几年,尤其是去年,能源股保持高位的原因。投资者可能越来越关注气候变化,但当他们看到回报时,他们仍然可以意识到这才是“真实回报”。他们在能源股中看到了这一点。

另一方面,这些能源股的发行商知道,正如雪佛龙公司首席财务官皮埃尔·布雷伯所说,“石油巨头的好时光不会长久,它们正在储备现金,以备当前的好时光结束。好时光结束的时间可能比预期的要早。 ”

英国《金融时报》在最近的一份报告中指出,自今年年初以来,标准普尔500指数的能源板块下跌了5%,而整体指数上涨了8%。油价在一个月内每桶下跌了约10美元。对经济衰退的恐惧情绪高涨,这对能源股造成了伤害,而这些股票即使在经济不景气的时候也能带来一定的回报。

在某种程度上,这种情况有点荒谬,正如美国能源咨询和分析公司PetroNerds首席执行官特里莎·柯蒂斯所描述的那样,“这些石油巨头在亏损的时候股价很高”。柯蒂斯对英国《金融时报》表示,“现在石油巨头赚了大钱,却得不到回报。”

据一些人说,人们担心随着油价下跌,能源公司将开始削减股息,其中一些公司的股息是可变的。似乎并非所有投资者都对此感到高兴。但是,在大型石油公司和小型石油公司也现金充裕之际,对能源股的怀疑还有一个更大的因素。

达拉斯联邦储备银行第一季度能源调查的一位受访者在评论部分表示:“据估计,油田作业成本增加了30%~40%,借款利息费用也增加了,天然气价格急剧下跌,加上原油价格下跌,导致现金流明显减少。”

同一位受访者表示:“外部投资者似乎对碳氢化合物失去了兴趣并指出全球经济和地缘政治前景的不确定性。我们预计,在一个周期性的行业中,会有另一个‘混过去’的时期,更多的参与者将被淘汰。”

英国《金融时报》援引的美国能源信息署(EIA)公布的数据显示,除了成本上涨和油井生产率下降外,声誉因素似乎比以往任何时候都更重要。达拉斯联邦储备银行调查的受访者表示,外部投资者正在对石油和天然气失去兴趣。PetroNerds的柯蒂斯表示:“市场和投资者仍然对石油和天然气感到不安。这些公司的价值并没有按照它们的资产或它们的产品来计算。”

在这样的背景下,至少在美国经济和全球经济前景变得更加明朗之前,没有什么比让股息保持接近、现金储备保持更接近更有意义的了。

李峻 编译自 油价网

原文如下:

Oil Majors Are Preparing For A Difficult Period

· The oil majors have been making record-high profits, but that hasn’t altered their capital discipline as they prepare for the next oil price rout.

· The energy segment of the S&P 500 has shed 5% since the start of the year, reflecting a fear that a recession will drive oil prices lower.

· The combination of higher operating costs, increased interest rates, and a drop in both oil and gas prices suggests the good times may soon be at an end.

The piles of cash Big Oil made from last year"s energy crunch have become the stuff of legend. They have also become a weapon in the hands of governments that like to have a scapegoat handy.

The weapon hasn"t been particularly effective, whether used to threaten the oil industry with windfall profit taxes or deployed by activists to add more detail to the already demonized image of the industry.

The industry, meanwhile, has kept its head down and its capital spending lower. The capital discipline trend appears to have become entrenched in oil and gas as companies seek to be prepared for the next price rout.

The Wall Street Journal reported this week that the seven largest oil and gas companies on the S&P 500 have accumulated a combined cash amount topping $80 billion. Exxon alone has a cash stash of close to $30 billion. Chevron has over $15.6 billion. EOG, the smallest among the big, has over $5 billion. And they are keeping it.

"They"ve paid dividends forever. That"s been a hallmark," Rob Thummel, managing director at energy investment firm Tortoise, told the WSJ. "But now there"s excess cash beyond dividends to do buybacks."

That"s what"s helped keep energy stocks high in the past couple of years and especially last year. Investors may be getting more climate-conscious, but they can still recognize a return when they see it. And they see it in energy stocks.

The issuers of those energy stocks, on the other hand, know that, as Chevron"s CFO Pierre Breber put it, "good times don"t last" and are conserving cash for when the current crop of good times ends. Which might be sooner than expected.

The energy segment of the S&P 500 has shed 5% since the start of the year while the broader index has added 8%, the Financial Times noted in a recent report. Oil prices have dropped by some $10 per barrel over a month. Fear of recession is running high and hurting energy stocks—those same stocks that carry with them the promise of certain returns, even in bad times.

In a way, the situation is kind of absurd, as described by PetroNerds" chief executive Trisha Curtis: "These companies had high share prices when they were losing money," Curtis told the FT. "Now they are making money hand over fist and not being rewarded."

According to some, there is concern that with lower oil prices, energy companies will start cutting their dividend—those of them that have made said dividend variable. It seems not all investors are happy about it. But there is a bigger factor for the energy stock skepticism that is emerging at a time when Big Oil and smaller operators too are flush with cash.

"An estimated 30–40 percent cost increase in field operations, increased interest charges on borrowed money, a drastic collapse in natural gas prices combined with lower crude oil prices produced a noticeable lower cash flow," one respondent to the Q1 Dallas Fed Energy Survey said in the comments section.

"Outside investors seem to be losing interest in hydrocarbons," the same respondent said, also noting the uncertain outlook on the global economy and geopolitics. "We expect another "muddle through" period in a cyclical business where more players will be winnowed out."

Besides cost inflation and lower well productivity, according to EIA data cited by the FT, the reputational factor appears to be stronger than ever. According to that Dallas Fed Survey respondent, outside investors are losing interest in oil and gas. According to PetroNerds"s Curtis, "The market and investors are still uncomfortable with oil and gas. The companies are not being valued to their assets or what they"re producing."

In a context like this, there is little that makes as much sense as keeping your dividends close and your cash pile closer, at least until some more clarity emerges about the future of the U.S. economy and the wider world.

(责任编辑:黄振 审核:蒋文娟 )